Our business model

Hunting’s financial and operational resources enable us to leverage our core competencies in systems design and production, precision machining and quality print-part manufacturing. This allows us to add value for our stakeholders.

Our business model

Hunting’s financial and operational resources enable us to leverage our core competencies in systems design and production, precision machining and quality print-part manufacturing. This allows us to add value for our stakeholders.

We have a strong brand & reputation

Hunting’s standing in the global oil and gas industry is supported by our skilled employees, our manufacturing and safety policies, and our aim to be close to where our customers operate. A key part of our strategy for growth and ambition for a high calibre reputation is through our commitment to our clients with many oil service and exploration and production companies relying on our expertise.

We have skilled manufacturers

The training and development of our employees helps us deliver for our customers. We operate complex machinery, supported by rigorous Health and Safety and Quality Assurance protocols which supports our service and products offering.

We add value for our customers

A common theme across all our businesses is our ability to add value for our customers, which is achieved by providing high technology products that lower the cost of operation, resolve technical problems, or simply enable a job to be completed more quickly or safely, without compromising on quality.

We develop proprietary technology

Developing our own proprietary technologies has been a strategic objective for the Group. Through the development of our proprietary know-how, we are well positioned to secure market share by utilising our intellectual property.

We strategically source critical materials

The Group has a strategy of ensuring that critical materials are not sourced from a single supplier which provides assurance to our customers that we will always be in a position to deliver. Long lead-time material supplies are regularly reviewed to ensure market pricing remains competitive. Hunting’s strategic sourcing includes working with a wide range of suppliers with a regular two-way dialogue on quality expectations.

Strong stakeholder engagement

Our engagement activities with our customers, suppliers and employees enable the Board to understand the needs of all our key stakeholders, and allow us to execute our strategy more efficiently. The discussions with our customers help us shape our new product development strategy, as clients seek to commercialise oil and gas reserves as safely and cost effectively as possible.

We look after our people

The Group has a strong reputation for being a responsible employer, which is reflected in the average tenure and voluntary workforce turnover rate. This demonstrates Hunting’s commitment to its employees and its drive to nurture a mutually beneficial relationship between the Company and its employees.

Significant capital resources

The Group ends 2021 with a strong balance sheet, supportive shareholders along with a new lending group which was finalised in February 2022. This financial strength will assist us in our growth strategy in the coming years, as the global oil and gas industry returns to growth.

Facilities

The Group has an established global network of operating sites and distribution centres located close to our customers and within the main global oil and gas producing regions.

Our operating sites are used for the manufacture, rental, trading and distribution of products. The manufacture of goods and the provision of related manufacturing services is, by far, the main source of income for the Group. A significant portion of our manufacturing occurs in high-end, specialist facilities utilising sophisticated machines. In Hunting’s rental businesses it is critical that an appropriate range of equipment is stored and maintained. Generally, this must be configured to meet specific customer requirements.

In certain product lines, particularly OCTG, Hunting holds inventory to support its customers’ requirements and to take advantage of particular market opportunities. Our distribution centres are primarily used in the Hunting Titan and intervention tools business groups, where close proximity to drilling operations is important.

Our operating segments

Hunting reports its performance based on its key geographic operating regions. Hunting Titan is a large, separate division, which is reported as a stand-alone segment that operates in several geographic locations. A description of each segment is noted below.

Hunting Titan

Hunting Titan manufactures and distributes perforating products and accessories. The segment’s products include perforating gun systems, shaped charge technologies and well completion instrumentation. The business has four manufacturing facilities in the US and one facility in Mexico, supported by 12 distribution centres, primarily located in Canada and the US.

North America

The North America segment was formed on 1 January 2021, following the merging of the Group’s US and Canada operating segments. The segment supplies OCTG, premium connections, subsea equipment, intervention tools, electronics and complex deep hole drilling and precision machining services for the US and overseas markets. The North America segment has 14 operating facilities, mainly located in Texas and Louisiana.

Europe, Middle East and Africa (“EMEA”)

The EMEA segment derives its revenue primarily from the supply of OCTG and intervention tools to operators in the North Sea. The segment has operations in the UK, the Netherlands, Norway, Saudi Arabia and the UAE. Revenue from the Middle East and Africa is generated from the sale and rental of intervention tools across the region, with local operations also acting as sales hubs for other products manufactured globally by the Group, including OCTG and perforating systems.

Asia Pacific

Revenue from the Asia Pacific segment is primarily derived from the manufacture of premium connections and accessories and OCTG supply. Manufacturing facilities are located in China, Indonesia and Singapore. The facility in China also manufactures perforating guns for Hunting Titan.

Oil country tubular goods (“OCTG”)

Operating basis: Manufacturing trading

Overview

OCTG are steel alloy products and comprise casing and tubing used in the construction and completion of the wellbore. Hunting machines threads to connect OCTG using flush or semi-flush joints and can manufacture premium and semi-premium connections and accessories using our own technologies such as SEAL-LOCK™, WEDGE-LOCK™ and TEC-LOCK™.

We are licensed to apply a variety of third-party thread forms and generic API threads. We source OCTG products from a significant number of major global steel producers and have strong, long-term relationships in the US, Canada, Europe and Asia Pacific. Hunting also trades pipe, which is a lower margin activity, to help support customer relationships.

Differentiators

Hunting is one of the largest independent providers of OCTG connection technology, including premium connections.

Global operating presence

North America, EMEA and Asia Pacific.

Related principal risks

• Commodity prices

• Shale drilling

• Competition

• Product quality

Perforating Systems

Operating basis: Manufacturing

Overview

Hunting Titan manufactures perforating systems, energetics, firing systems and logging tools. Products are mainly used in the completion phase of a well. The production, storage and distribution of energetics is highly regulated and there are significant barriers for new entrants to the market. The business mainly “manufactures to stock” and hence uses a wide distribution network. Some manufacturing is done to order, sourced from international telesales.

Differentiators

Hunting has a market-leading position in the US, supported by a strong portfolio of patented and unpatented technology.

Global operating presence

Operating sites in North America, Mexico and China. Distribution centres in North America and Asia Pacific.

Related principal risks

• Commodity prices

• Shale drilling

• Competition

• Product quality

Advanced Manufacturing

Operating basis: Manufacturing

Overview

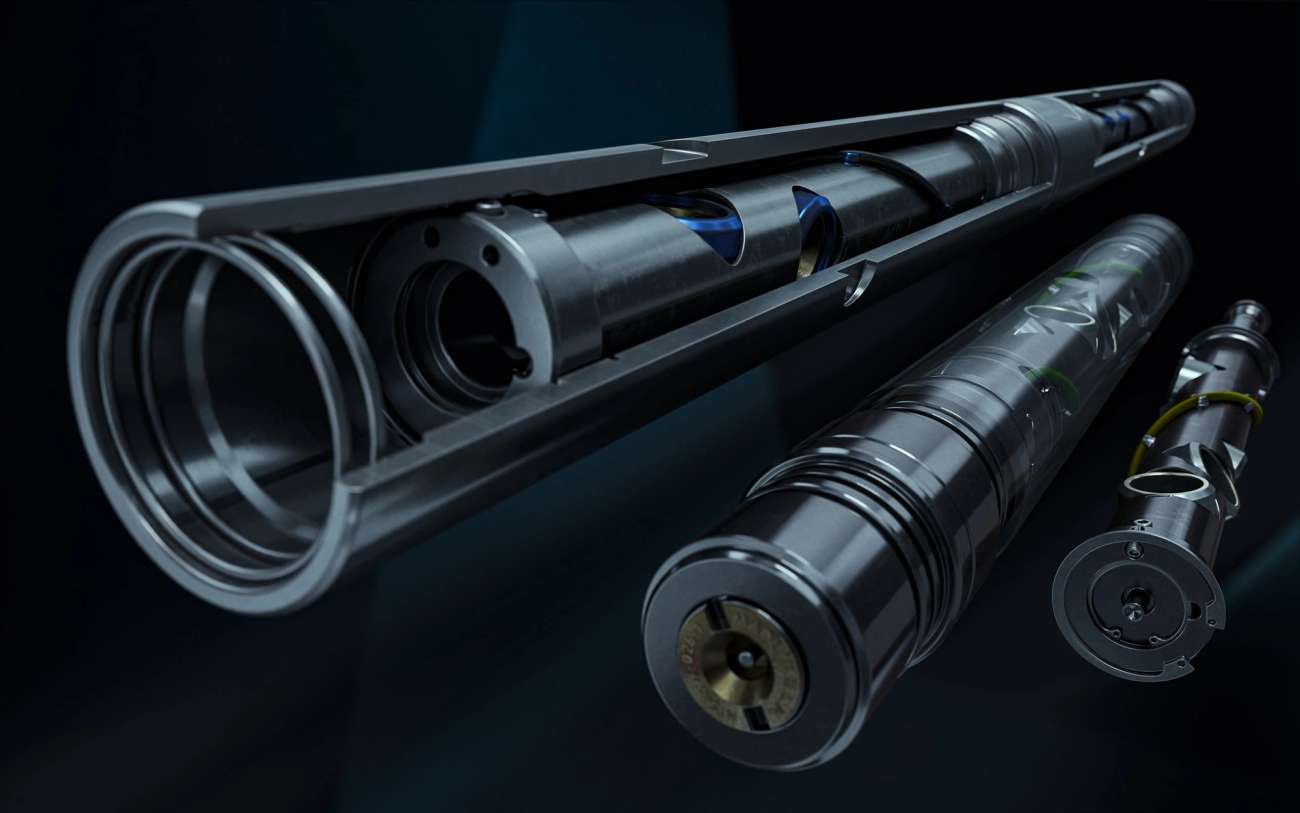

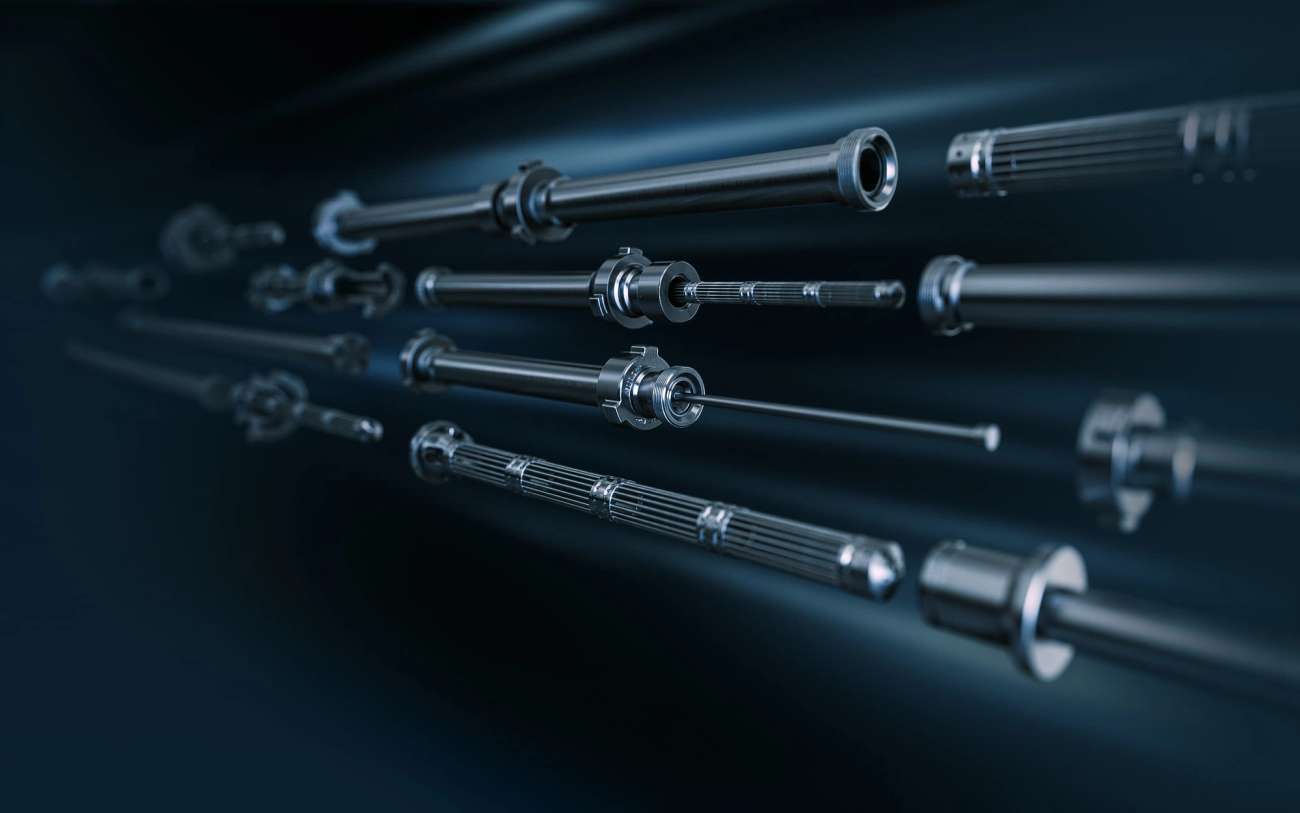

Advanced Manufacturing includes the Hunting Dearborn business, which carries out deep hole drilling and precision machining of complex measurement-while-drilling/ logging-while-drilling (“MWD/LWD”) and formation evaluation tool components.

The Hunting Electronics business manufactures printed circuit boards capable of operating in extreme conditions. These businesses work collaboratively with customers implementing their designs to their specifications. Hunting Specialty manufactures products used for onshore drilling and completion activities.

Differentiators

Hunting Dearborn is a world leader in the deep drilling of high grade, non-magnetic components. As a Group, Hunting has the ability to produce fully integrated advanced downhole tools and equipment, manufactured, assembled and tested to the customer’s specifications.

Global operating presence

North America

Related principal risks

• Commodity prices

• Product quality

Subsea

Operating basis: Manufacturing trading

Overview

The Subsea division produces high quality products and solutions for the global subsea industry covering hydraulic couplings, chemical injection systems, valves and weldment services.

Following the acquisition of RTI Energy Systems, now known as Subsea Spring, titanium and stainless steel stress joints and production risers have been added to the Group’s subsea portfolio.

The addition of Enpro Subsea’s product offering also brings modular production technology and know-how to our offshore capabilities.

Differentiators

Hunting’s expertise ranges from the manufacture of high pressure seals to complex welding of stress joints

Global operating presence

North America and EMEA.

Related principal risks

• Commodity prices

• Product quality

Intervention Tools

Operating basis: Manufacturing equipment rental trading

Overview

The Group manufactures a range of downhole intervention tools including slickline tools, e-line tools, mechanical plant, coiled tubing and pressure control equipment.

This business is capital intensive and results are dependent on asset utilisation and rental rates.

Differentiators

Hunting offers a comprehensive range of tools, including innovative and proprietary technologies.

Global operating presence

North America, EMEA and Asia Pacific.

Related principal risks

• Commodity prices

• Competition

Other non-oil and gas

Operating basis: Manufacturing

Overview

Across the Group, efforts have been stepped up to diversify revenue streams and leverage our core competencies into new markets.

In the year, Hunting has developed new sales streams in the military and medical sectors, primarily via our Dearborn and Electronics businesses.

In the year, the Group’s Asia Pacific segment also delivered its first batch of micro hydro generation systems.

Differentiators

Hunting’s complex, precision machining capabilities are applicable to many other sectors outside of oil and gas.

The Group has successfully positioned itself with a number of defence related businesses who recognise our expertise.

Global operating presence

North America, Asia Pacific.

Related principal risks

• Product quality

Our stakeholders

The Group’s stakeholders enable the delivery of Hunting’s business model and strategy.

Stakeholder engagement forms a key element of our culture and is an area which has increased over the past few years.

Understanding the needs of our shareholders, customers, suppliers and workforce is achieved by regular dialogue.

Shareholders & lenders

Our shareholders provide equity capital to the Group. Our institutional investors are mainly located in the UK and shareholder returns are predominantly in the form of dividend distributions. The Directors regularly engage with shareholders to discuss strategy, governance and other matters. This feedback is used to refine our strategic plans.

Our employees

Hunting’s employees deliver our strategic plans. Since 2019 we have increased our engagement activities through perception surveys and town hall meetings. During 2021, the Board’s interaction with employees included an employee engagement event at the Group’s Subsea business unit, where Annell Bay, the designated nonexecutive Director for employee engagement, met staff in Houston.

Our customers

Our clients are critical to the financial success of the Group. Customer dialogue helps us shape our strategy and provides focus to our service offering. Often, customer feedback helps us define new product development.

Suppliers

Hunting’s supply chain has increased in importance during 2021 as raw material and component costs have increased. We have worked hard to ensure a secure supply chain in the year, to enable us to continue to deliver for our customers.

Environment & climate

The Group’s environmental impact has also been an area of increased scrutiny by investors during 2021. In the year we have created new ESG and TCFD steering groups to enhance the measuring and monitoring of our carbon footprint as well as completing analysis to understand the longer term climate opportunities and risks to our business model.

Governments

The Group has continued its engagement with local tax authorities in the year to remain fully compliant with all evolving legislation.

Our communities

Hunting continues to assist communities through a wide range of activities. Throughout the COVID-19 pandemic, the Group has provided safety masks to at-risk members of the community.

Sustainability accounting standards board (“SASB”) reporting

Throughout this section, Hunting has introduced the SASB reporting codes relevant to its non-financial data. Please refer to the SASB reporting tables on pages 226 and 227, which provide the detail to each area of reporting, Hunting’s compliance to the reporting recommendation and the page location of the relevant information.