Results & reports

Recent and historic financial results and reports.

Annual Report & Accounts 2022

Download Hunting's latest report

Annual General Meeting 2023

This year's Annual General Meeting will be held on Wednesday 19 April 2023 at 10.30 a.m in London, UK

Current investor presentations

View our 2022 full year results presentation and webcast playback.

Latest trading update

View our latest trading updates.

Financial highlights

Order book increased by 124% to $473.0m.

Revenue increased by 39% to $725.8m.

Gross margin improved to 24% from 12%.

Return to profitability with EBITDA of $52.0m and adjusted profit from operations of $14.6m.

Total dividends declared in the year of 9.0 cents per share.

Financial summary

First table: Financial Performance measures as defined by the Group* Second table: Financial Performance measures as derived from IFRS

* Adjusted results exclude adjusting items agreed by the Audit Committee and Board.

** Non-GAAP measure (“NGM”). Please see the 2022 Annual Report and Accounts pages 240 to 246.

*** Payable on 12 May 2023 to shareholders on the register on 21 April 2023, subject to approval at the Company’s AGM.

Revenue

EBITDA**

Adjusted profit (loss) from operations**

Net assets

Total cash and bank**

Adjusted diluted earnings per share**

Final dividend proposed***

Profit (loss) from operations

Diluted earnings per share

| 2022 | 2021 | Variance | |

|---|---|---|---|

| Revenue | $725.8m | $521.6m | +39% |

| EBITDA** | $52.0m | $3.1m | +$48.9m |

| Adjusted profit (loss) from operations** | $14.6m | $(35.1)m | +$49.7m |

| Net assets | $846.2m | $871.3m | -$25.1m |

| Total cash and bank** | $24.5m | $114.2m | -$89.7m |

| Adjusted diluted earnings per share** | 4.7 cents | (27.1) cents | +31.8 cents |

| Final dividend proposed*** | 4.5 cents | 4.0 cents | +0.5 cents |

| 2022 | 2021 | Variance | |

|---|---|---|---|

| Profit (loss) from operations | $2.0m | $(79.7)m | +$81.7m |

| Diluted earnings per share | (2.8) cents | (53.2) cents | +50.4 cents |

Operational and Corporate Highlights

Strong increases in activity across all operating segments as higher commodity prices support new global drilling projects.

External sales order book increased 124% during the year to $473.0m (2021 – $211.5m). Revenue visibility increased due to level of order book, which now extends into 2025.

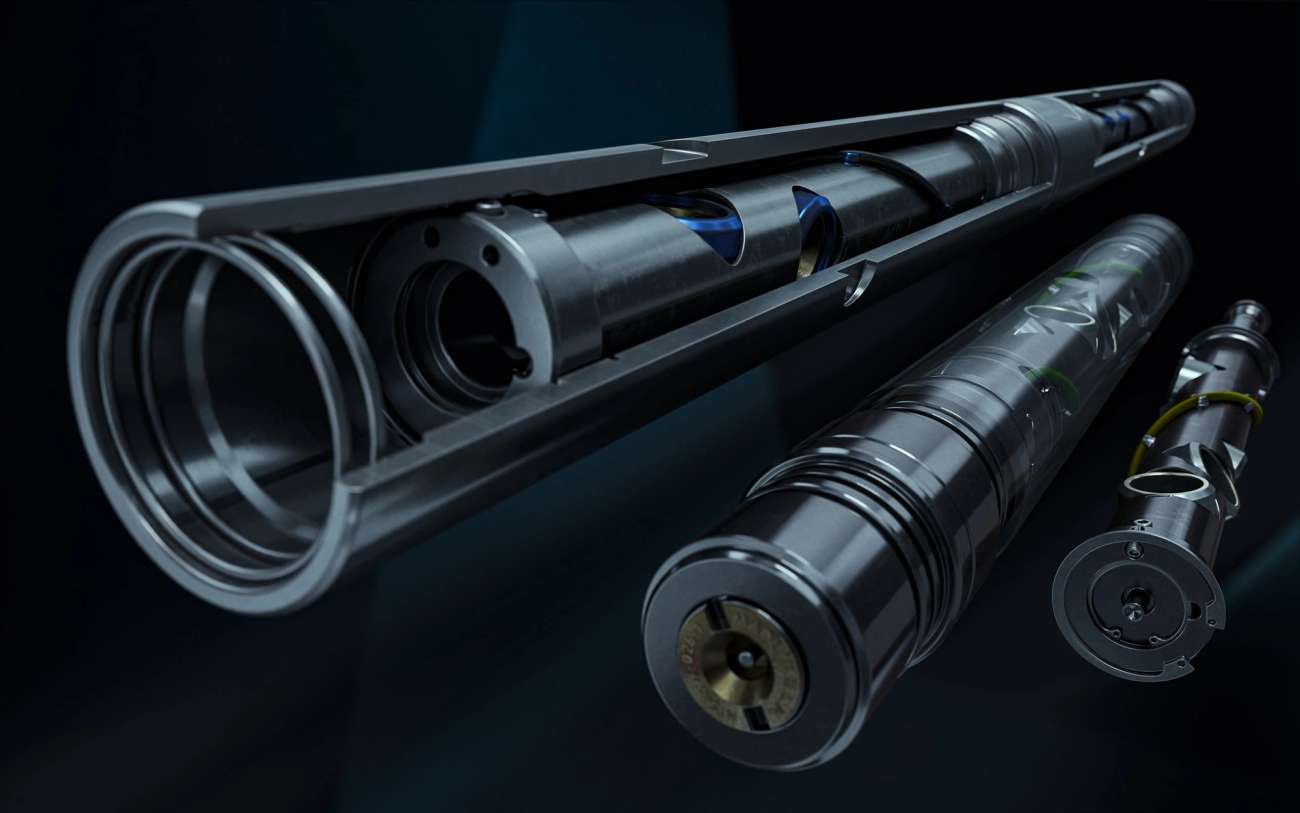

139% increase in sales order book within the Subsea Technologies division to $105.1m.

The Subsea Spring business unit has grown materially during the year, following new orders for steel and titanium stress joints for the Gulf of Mexico and South America. Record $48m order received in October 2022 to apply stress joints to FPSO units.

Record OCTG contract awarded by CNOOC for Premium Connections and Accessories.

In August 2022, the Group’s Asia Pacific operating segment was awarded a contract for OCTG that management estimates to be worth up to $86m for Hunting’s proprietary SEAL-LOCK XD™ premium connection. Vast majority of order to be delivered in 2023.

Strong development of non-oil and gas sales order book within the Advanced Manufacturing group.

The Dearborn business now has a sales order book of $71.3m, which comprises c.68% of non-oil and gas sales. The Electronics business now has a sales order book of $49.8m, which comprises c.14% of non-oil and gas sales.

Construction of a new threading facility in India commenced with Jindal SAW to support domestic activity.

Facility to be operational during Q2 2023 with three premium connection threading lines. 162,000 sqft facility is located in Nashik Province, adjacent to Jindal’s steel mill. Hiring of employees and QA training underway.

Formation of global Energy Transition group to build sales in geothermal and carbon capture market sub-sectors.

Hunting is pursuing a broad range of sales opportunities in these growing low carbon sub-sectors, leveraging its position in OCTG and accessories, valves and couplings and subsea products to drive growth. The Board has set a revenue target of $100m of sales within this area by the end of the decade.

$150m Asset Based Lending facility agreed in February 2022.

Borrowing base secured against certain North American freehold property, inventories and trade receivables. Facility agreed with four-year tenor. The facility provides an appropriate funding base to pursue growth opportunities.

2022 strategic highlights

The Group has delivered on a number of strategic objectives during 2022.

Continue to capitalise on Hunting’s proven capabilities in energy services

Stimulate further growth, rebuild baseload earnings and stabilise profitability

Supported by the strong outlook for global oil and gas sales (North America, Europe, Middle East and Asia Pacific) Furthered through diversifying revenue across non-oil and gas sub-sectors where the Group can leverage existing expertise Delivered through both organic and inorganic growth opportunities

Resulting in a long-term EBITDA margin target of 15%

Sustainable and growing dividend policy targeting an average increase of c.10% per annum until the end of 2030

Results archive

- Title Type XHTML Webcast File

Annual Report and Accounts 2022

ReportView PDFFull Year Analysts Presentation 2022

PresentationListen PDFHalf Year Report 2022

ReportListen PDFHalf Year Analysts Presentation 2022

PresentationListen PDFResults of AGM 2022

ResultsAGMPDFAGM Presentation 2022

AGMPresentationListen PDFForm of Proxy 2022

Proxy formAGMPDFNotice of AGM 2022

NoticeAGMPDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2021

ReportView PDFFull Year Report 2021

ReportPDFFull Year Analysts Presentation 2021

PresentationListen PDFHalf Year Report 2021

ReportPDFHalf Year Analysts Presentation 2021

PresentationListen PDFResults of AGM 2021

ResultsAGMPDFAGM Presentation 2021

PresentationAGMListen PDFForm of Proxy 2021

AGMProxy formPDFNotice of AGM 2021

AGMNoticePDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2020

ReportPDFFull Year Report 2020

ReportPDFFull Year Analysts Presentation 2020

PresentationListen PDFHalf Year Report 2020

ReportPDFHalf Year Analysts Presentation 2020

PresentationListen PDFResults of AGM 2020

AGMResultsPDFForm of Proxy 2020

AGMProxy formPDFNotice of AGM 2020

AGMNoticePDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2019

ReportPDFAnnual Report Presentation 2019

PresentationListen PDFHalf Year Report 2019

ReportPDFHalf Year Analysts Presentation 2019

PresentationPDFResults of AGM 2019

AGMResultsPDFForm of Proxy 2019

AGMProxy formPDFNotice of AGM 2019

AGMNoticePDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2018

ReportPDFAnnual Results Analysts Presentation 2018

PresentationListen PDFHalf Year Report 2018

ReportPDFHalf Year Analysts Presentation 2018

PresentationListen PDFResults of AGM 2018

AGMResultsPDFForm of Proxy 2018

AGMProxy formPDFNotice of AGM 2018

AGMNoticePDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2017

ReportPDFAnnual Results Presentation 2017

PresentationListen PDFHalf Year Report 2017

ReportPDFHalf Year Presentation 2017

PresentationListen PDFResults of AGM 2017

AGMResultsPDFForm of Proxy 2017

AGMProxy formPDFNotice of AGM 2017

AGMNoticePDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2016

ReportPDFAnnual Results Presentation 2016

PresentationListen PDFHalf Year Report 2016

ReportPDFHalf Year Presentation 2016

PresentationListen PDFResults of AGM 2016

AGMResultsPDFForm of Proxy 2016

AGMProxy formPDFNotice of AGM 2016

AGMNoticePDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2015

ReportPDFAnnual Results Presentation 2015

PresentationListen PDFAnnual Results 2015

ResultsPDFHalf Year Report 2015

ReportPDFHalf Year Presentation 2015

PresentationListen PDFResults of AGM 2015

AGMResultsPDFForm of Proxy 2015

AGMProxy formPDFNotice of AGM 2015

AGMNoticePDF